The most interesting thing about the on-line gambling ban imposed on US residents is the settlement the US reached with other countries. Most notably, the part that says that the settlement is a matter of national security, and thus the exact amount cannot be disclosed. We only now that a separate settlement, with Antigua, will cost the taxpayers $21 million annually. The estimates for the larger settlement with the EU and other countries range in tens of billions of dollars, presumably as a lump sum.

Making a wild and completely unjustified assumption, let's say that American lawmakers have enough common sense to make this settlement economically viable. For that, they should estimate the amount of economic damage to US gambling providers. Further, let's make a stupid assumption that without the ban US gambling operation would not launch their own on-line presence, and focus only on the current off-line revenues as a basis on the damage calculations.

The federal and state governments derive most of their gambling revenues from two sources: lotteries and casinos. Lotteries are justly called taxes for the stupid. In fact, as early as the Revolutionary War, lotteries were used to finance the American side. Last year, lottery spending has reached nearly 1% of all household spending in the US, with rates varying from 0% (six states have banned lotteries) to nearly 5% (with the exception of Rhode Island, where spending was at 7.47%, but most of it came from out of state purchases). The total lottery revenues reached $56.7 billion.

It is important to realize that lotteries offer much lower chances of winning than casino games. Usually, about fifty cents on each dollar is being paid off in winnings; the rest is officially used to pay for lottery expenses and special projects, such as school funding. (In truth, that money more often than not replaces budgetary spending, and thus can be considered budget income in the first place.) Lotteries also feature very steep double taxation. In addition to the 50% tax one pays by purchasing a lottery ticket, the winners have to pay income taxes, and the large winnings put them automatically into the 35% tax bracket. At the end of the day, on aggregate lottery players receive only 32 dollars and 50 cents for each 100 dollars spent. Subtracting lottery costs, the states and federal government end up with 52.5% of all lottery revenues.

So we have our first number - government's income from lotteries was around $29.8 billion last year. But how about casinos? Their revenue varies wildly, depending on who you ask. Some place their revenue at $637 billion for last year, but that's the total amount of wagers placed in the casinos. The casinos themselves report a total revenue of $54 billion, which is the amount they won from the players, but before their operating costs (by the way, that's only about 8.5 cents for each dollar wagered). Casinos have reported income taxes of $5.2 billion for commercial venues and $1.44 billion for racetrack operations, for a total of $6.64 billion.

So the total number of gambling income was $36.44 billion last year. To estimate how much would on-line gambling damage this income is impossible. Anyone who gives you a number just pulls it out of thin air. Last year, worldwide wagers in on-line gambling reached $18 billion. Assuming the absolutely worst-case scenario, that this amount would displace revenues for lottery games, this would cost various US governments about $9.5 billion in spending. Most likely, assuming the current distribution of wagers in the US, 92% at casinos and 8% for lotteries, the damage to government budgets would go down to $0.95 billion. All this, of course, assuming that the 100% of on-line gambling revenues came from the US, total displacement of revenues at other gambling sources (as opposed to increased gambling spending), and no on-line gambling operation based in the US and thus paying income taxes.

There you have it: the highly unrealistic, worst-case scenario would cost American federal and state governments between $0.95 and $9.5 billion last year. At the same time, the government refuses to release the settlement amount, despite the very public estimates that it reached tens of billions of dollars. This leads me to believe that the final amount may have been higher. Again, let's make some wild assumptions: let's say the settlement was between $20 billion (the lowest possible amount for "tens of billions"), and $100 billion (just a convenient number), and a 4% interest rate (within the range of this year's federal funds rate). It would take the US gambling industry 3 to 120 years to repay that settlement. (Note: I made one assumption against the government, by not suggesting any revenue growth for the on-line gambling industry, and while in a short to medium range this should not have a significant effect, at the high end of the range the number is probably way out of whack.)

From how I see it, the settlement caused by the on-line gambling ban was not paid for economic reasons, as the repayment period may be longer than any of our lifetimes, and definitely longer than the lifetime of the Internet in the form we know now. Let me rephrase that: the settlement was not paid for the "greater good" economic reasons; as some lawmakers already so eloquently showed us, gambling bans may have significant personal economic benefits. Even those would be just a fraction of the cost of the settlement. I just can't shake the feeling that I'm paying at least a hundred dollars for the privilege of not having the choice to spend my money in a different way. Kind of like the prisoners paying for the privilege to be kept in jail. Actually, with the insane already running the asylum, that may not be a bad analogy...

Friday, March 21, 2008

Tuesday, March 18, 2008

A quick note on inflation

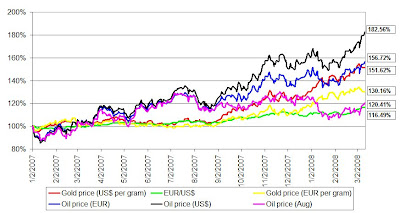

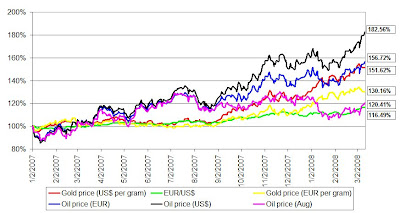

The dollar keeps falling against the Euro. Oil and gold have hit new highs. Bernanke has printed a few billions of extra bills to bail out a bank. The sky is falling! I've put together a quick and dirty chart on the change in prices of oil, gold and Euro. It doesn't look all that bad for the dollar...

What we see here is a flight to commodities, but not a serious inflation of the dollar. The scale is from 100% on January 1 2007 to yesterday, and as we can see, during that time the price of Brent crude (spot) appreciated by slightly over 80%. That's a huge jump, but look at what was happening to the oil price in Euros and in grams of gold: until late August 2007 all three prices changed nearly identically. This indicates that oil prices have moved independently of the dollar until then, influenced only by supply and demand (and the perception of those). After that, two things happened: the dollar started growing weaker against the Euro, and the gold has taken off. Oil prices in grams of gold (Aug) has plateaued out.

The vast majority of the exchange rate swing took place between September and December; for the rest of the time the rate moved only very slightly. This is attributable to a number of factors, but a 15% exchange rate swing for two currencies that are not tied (in fact, they appear to be in global competition, not only for the distinction of reserve currency, but also as the price factor for two major import blocs) is not all that large. Gold, on the other hand, has grown in price primarily after the exchange rate between the dollar and Euro stabilized, and in fact, it's grown faster than the price of oil. This indicates a flight to safety, not excess inflation. Given inflation of around 3% in the Eurozone and 4% in the US, the growth in the price of gold was abnormally high, indicating a possible bubble. Moreover, considering that the commodity prices changed largely when there was little or no change in the US$/EUR exchange rate, we can safely assume that commodities have moved independently of the price of the two currencies, and not as a result of excess inflation.

What we see here is a flight to commodities, but not a serious inflation of the dollar. The scale is from 100% on January 1 2007 to yesterday, and as we can see, during that time the price of Brent crude (spot) appreciated by slightly over 80%. That's a huge jump, but look at what was happening to the oil price in Euros and in grams of gold: until late August 2007 all three prices changed nearly identically. This indicates that oil prices have moved independently of the dollar until then, influenced only by supply and demand (and the perception of those). After that, two things happened: the dollar started growing weaker against the Euro, and the gold has taken off. Oil prices in grams of gold (Aug) has plateaued out.

The vast majority of the exchange rate swing took place between September and December; for the rest of the time the rate moved only very slightly. This is attributable to a number of factors, but a 15% exchange rate swing for two currencies that are not tied (in fact, they appear to be in global competition, not only for the distinction of reserve currency, but also as the price factor for two major import blocs) is not all that large. Gold, on the other hand, has grown in price primarily after the exchange rate between the dollar and Euro stabilized, and in fact, it's grown faster than the price of oil. This indicates a flight to safety, not excess inflation. Given inflation of around 3% in the Eurozone and 4% in the US, the growth in the price of gold was abnormally high, indicating a possible bubble. Moreover, considering that the commodity prices changed largely when there was little or no change in the US$/EUR exchange rate, we can safely assume that commodities have moved independently of the price of the two currencies, and not as a result of excess inflation.

Subscribe to:

Posts (Atom)